the BONUS! the GUARANTEE!

So what can you do to improve the pulling power of your offer? It’s easier than you think: simply add a bonus and a guarantee to what you are already proposing.

Let’s take a closer look.

First off, the bonus. Think of your bonus as the icing on an already good cake, the reward or extra incentive your prospects receive for taking action or for doing what you want them to do.

You see, if you have made your offer and they are still listening or reading your letter or website, I would say they are interested in what you are selling.

Your bonus is that extra reason that takes their interest to the next level, to the stage of actually acting on your offer.

If you’ve ever watched TV infomercials, then you’re well-familiar with the attention-grabbing power of, “But wait, there’s more!”

Often, the bonus is more of the same, at no extra cost (an extra set of Ginsu knives), another product (a cheese grater with your Slap Chop), or a supply of any product consumables (extra ink cartridges for a printer). Those are all known as related offers.

But unrelated offers work equally well: movie theatre tickets, gas cards, a nice pen, a donation to your favourite charity, a free book or report, free Air Miles … Almost anything you can think of that would be desirable to your target audience can become a bonus offer.

Bonuses need not add a lot of extra cost to your sales, or even any cost at all. You might find a company willing to supply you with free products, or products and services at a discount, or you might buy other incentives, in bulk, at a very low per-unit price. Just be sure your bonus offer has a clear, unmistakable value to your prospect – a bonus the prospect has no interest in is no bonus at all.

So now you’ve sweetened your already great offer with a valuable bonus. It’s time to close the deal. It’s time to remove the buyer’s risk from the transaction. You do this with a guarantee – the second component that will improve the pulling power of your offer.

The fancy marketing term for this is “risk reversal.” Risk reversal is when the seller takes away the financial, psychological, or emotional risk factors attached to the decision-making process of purchasing your product or service.

Risk reversal shows the client you are confident your product or service will do what you say it will do. It shows the customer you can deliver on your promises. Taking away risk lowers the barriers to gaining your customer’s trust, and thereby eliminates one of the main obstacles to buying.

Let your prospects know early that you are committed to their satisfaction. If they are ever dissatisfied, you’ll take care of it.

Your guarantee can offer money back; it can offer lifetime or limited time product replacement; it can promise to redo the job to their total satisfaction – whatever it takes to make your buyer feel safe.

If you’ve never offered a guarantee before, it may seem risky to you – all that expense of redo’s, replacements and refunds. But, in fact, guarantees are very safe to offer, provided your products or services are of reasonable quality. The US Direct Marketing Association reports that the average take-up rate on guarantees is just two percent, or less. So don’t fear offering a guarantee. All other things being more or less equal, people would rather buy from a business that offers the security of a guarantee.

You may think people are immune to the lure of guarantees, but test after test shows that the same offer attached to a guarantee will out-pull an offer with no guarantee.

Adding a good bonus to your offers and backing them with a solid and genuine guarantee is the one-two combination that takes your everyday, same-old, same-old offers over the edge, making them interesting, exciting and, most importantly, irresistible to your target market.

Five Emotions

How is it possible that many people with less intelligence, ability and ambition consistently achieve more than you do?

Keep reading for the surprising results from a Harvard experiment that shows you how to perform better… with less effort — and, achieve your goals… faster!

Are you hooked? I know I am.

Now, this article has nothing to do with the Harvard experiment mentioned. I am using these two lines, which I found as “teaser” copy from an ad promoting a self-development program, to illustrate the importance of getting your message noticed, and how to motivate people to action in response to your advertising and promotions.

The first line is designed to grab you. The next one is designed to propel you forward. How? Because they make superb use of the Five Prime Motivators, which are, according to direct marketing guru Herschell Gordon Lewis: Fear, Greed, Guilt, Exclusivity and Approval.

The beauty of the two lines is that they make direct use of the first four motivators, and indirect use of the fifth. That makes them a rare piece of copy, indeed. Here’s how they do it, in descending order of emphasis:

Guilt – Who hasn’t felt at some time that they weren’t doing all they could to achieve the kind of success they want in life? Have any of you fully tapped your potential?

Exclusivity – You’re being told you’re smarter than those who are making it – others who are less intelligent, able and ambitious than you.

Greed – If only you could achieve according to your potential, you could have all that success brings – all that those other, less capable people have.

Fear – You’re losing out. If you don’t do something soon, you’ll never have success. You’ll be a failure!

It’s a golden rule in direct marketing that if you pose a problem, you must also show that you have the answer, which is what the second line of copy does (“Keep reading for the surprising results…”).

Implicit in the copy is the idea that once you start fulfilling your potential, you will boost your self-esteem and enjoy the approval of others.

In light of the Five Prime Motivators, think about why some advertising messages work and some don’t.

When you are trying to motivate someone to do something right now – whether to buy, or simply let them know you are interested – clever headlines, smart copy and arresting images don’t work nearly so well as insightful and appropriate use of one or more of Lewis’s five motivators.

I recently read some research that every day we are exposed to 1,600 advertising messages. What “exposed to” includes is every ad that comes on TV while we are watching, every billboard we pass, every ad in every newspaper or magazine we pick up, and every ad we hear on the radio. It is the equivalent of watching over 12 solid hours of commercials daily.

Mercifully, we pay little attention to most marketing messages. Scarcely 10 percent even enters our awareness, and only a small fraction of that ever prompts us to go out and buy.

So, how do you get people’s attention? There are many different ideas about why people respond to advertising. Some think type and layout are important. Some think it is the type of media or medium used. Others say brands and compelling images do the job. Once in a while some out-of-the-loop marketer claims, “Sex sells!” Believe me, it doesn’t, unless sex (or something closely related to it) is what you are selling.

Making your ad stand out is a tough job. If you are trying to promote or maintain awareness of your brand, then clever headlines and arresting images may work; they may help you retain top-of-mind with consumers. But if you want people to act, you must motivate them.

Let me ask you: How do you feel about your current advertising and marketing? Are your messages as strong, motivating and action-inducing as they could be?

Savvy marketers know that an irresistible offer backed by strong copy using one or one or more motivators is what really sells in advertising.

Sustainable competitive advantage

How do you build a sustainable competitive advantage for your company? With so much changing these days, where does your product have to be? How about your service levels? What about your relationships?

In order to build and maintain a sustainable, competitive advantage, you need to have competitive products (i.e., as good as your competition); superior service (better than your competitors); and killer relationships (i.e., to die for).

Products Many people try to build an advantage by having superior, a.k.a. killer, products. Any advantage gained here will not be sustainable. Hard products (i.e., goods) are most susceptible to reverse engineering and replication, quite often at a lower price. This is the most competitive category, and as a result, most price-sensitive as well. Given there are 6 billion people out there, it is very difficult to stop others from taking your products and improving on them, and usually for a cheaper price. Reverse engineering is very common these days. To maintain a competitive sustainable advantage at this level is nearly impossible.

Services Services are a little easier to maintain as an advantage over competitors. They are more intangible, and therefore less price-sensitive. As a result, you might be funded better with services, and you will be able to deliver services that are superior to your competitors. To go killer in this area, however, is just too expensive to provide in a cost-effective manner. There are financial parameters and constraints to the services you may provide. Additional service costs money. As a result, a sustainable competitive advantage does not lie in this area alone.

Relationships Here we are at last! The area that doesn’t cost a fortune, and that generates big rewards for those who use it. You care, and you need and want to demonstrate this care to your customers.

You can do this through your relationships with them. A relationship, developing that human connection with another person, is most cost-effective, and paradoxically yields the highest results. The more that can be done in the area of relationship-building, the better. Think about it. How many places do you shop right now that aren’t necessarily the cheapest, but you go back anyway? It’s all because of your good relationship with the people there.

People aren’t interested in how much you know until they know how much you care. The impact of relationships on competitive advantage is amazing. We have heard many stories of people going out of their way, including one person actually driving over 100 miles to get his car serviced with a particular company, because “the people really care.”

In this case, the owner of a Mercedes dealership (near where the customer used to live) had heard about the life-threatening illness of a customer’s nine-year-old boy, a kid who happened to love hockey. The dealership owner made arrangements for the child and his dad to attend an NHL hockey game, where the son was also acknowledged by the team (complete with a hockey stick autographed by all the players). That special night and the stick made a significant impact. They were tokens of hope for the boy as he went through numerous difficult surgeries.

The cost to the owner of the dealership was a pair of his season tickets and a phone call to a friend. The impact on the boy and his dad was priceless, and now, after moving, the dad will never consider having his car serviced anywhere else, even though there is another Mercedes dealership in his new town.

The advantage of superior or killer products may be anywhere from six months to two years, but after that it is gone. Due to market forces – hungry competitors willing to offer the same for less – the advantage gained will become unsustainable from a cost point of view.

Killer relationships, on the other hand, are the basis of true sustainable competitive advantage. With these, anything is possible. By understanding the importance of relationships in business, you will be able to gain and keep more customers at a profit, consistent with your goals and commitments in life.

Tap fear and greed.

tap fear and greed. This typically starts with creating fear to destabilize the person, then offering a 'sure thing' that sucks them in.

Eight Steps

Step 1: Identify your audience All good communication is tailored to its audience, so you need to know who you’re writing for.

This may sound simple but you have to be precise. Even people working for the same organisation can have very different viewpoints.

A chief technology officer might be most concerned with how easy a new system is to implement. The chief financial officer might care most about how it improves efficiency. Identify which role you’re targeting. This will have a major influence on how you write your paper.

Step 2: Identify the problem the paper will address A successful white paper has to address a significant problem, which your prospects are facing and your product or service can solve.

This problem is both the hook to get your prospects to read the paper and the justification for your sales pitch at the end. It could be something that’s holding their business back, changes to their industry or an opportunity they don’t know how to take.

It’s best if your paper addresses only one problem, as this focuses your argument and keeps your paper concise. If you have more problems to cover, think about a series of papers.

Step 3: Prove you understand the problem thoroughly Showing your prospects that you know what they’re going through builds trust and an emotional connection with them. These are both vital factors for getting your paper read and for your sales pitch to work.

Gather the evidence you’ll need to show this understanding. Points you can reference include:

how your prospect will suffer if they don’t solve the problem, whether that’s lost sales, higher costs or a damaged reputation any third-party statistics or quotes that support your claims an analysis of trends that show the problem’s significance, and the solutions people have tried so far and why they’re ineffective. This isn’t an exhaustive list. If there’s something specific to your industry that helps you make your case, such as a legal ruling or new regulations, then use it.

Step 4: Figure out the problem’s emotional impact If the problem you’ve identified is genuinely significant to your prospects, they’ll be feeling powerful emotions about it. These will probably be variations of fear or greed.

Fear

Your prospects may be scared of:

making a mistake that will cost their company money or attract bad publicity getting into trouble with their boss or the company board losing the respect of their peers and their team missing out on a bonus, pay rise or promotion, or losing their job.

Greed

If they solve the problem, your prospects might get more money or a better job. It could even increase their company’s value.

If you analyse your prospects’ emotions, you can subtly acknowledge them in your paper. This helps your prospects to identify with what you’re saying and to see you as a way to fix their problem.

Step 5: Work out the solution to your prospect’s problem If your prospects are going to value and trust your paper, they have to see it as an educational piece and not a sales brochure. When you explain how to solve their problem, you therefore need to set out a generic solution. This will, of course, be remarkably similar to your product or service, but this isn’t the place to make your pitch.

Instead, you need to make the case that this generic solution is what your prospects are looking for. This includes:

the reasons this solution fixes the lost sales, increased costs or other issue they’re facing any statistics or quotes, particularly from third parties, that show the solution is effective, and why this solution is better than the alternatives Don’t forget to consider how this solution will meet your prospects’ emotional needs, which you identified in step 4.

Step 6: Work out your sales pitch At the end of your paper, it’s fine to set out a brief explanation of why you’re the real answer to the problem. You need to make clear that your product or service offers all the benefits of the idealised solution you created in step 5.

Show that your solution works, through a short case study or statistics that demonstrate your customers’ successes. This ‘social proof’ is a powerful way of reassuring your prospects that you provide what they need.

Step 7: Decide what you want them to do next When they’ve finished the paper, you want your prospects to take action. This could be to contact you to discuss their needs or to ask for a quote.

Whatever you want them to do, think how you can make it as easy as possible for them. They have to perceive that the value of taking that next step is greater than the effort of doing so. Don’t make them fill in a huge contact form with dozens of compulsory fields. And don’t make them commit to a meeting or a sales call, unless that’s what they want.

Step 8: Write your paper You should now have everything you need to write an effective white paper, which naturally fits into the following structure:

- introduction

- the problem

- the solution

- the sales pitch

- call to action

Think about how to make this work best for you. For example, lists are powerful ways of presenting information, so setting out the problem as ‘three reasons X isn’t working’ or the solution as ‘five steps you should take to fix X’ can be very effective.

what's in it for them?

Prospects are most likely to buy products and services if, 1) it helps their company achieve its goals, and, 2) helps them as individuals achieve a personal goal. We refer to the first as business results and the second as personal wins. We need to discover what constitutes results and wins for everyone who has influence on our account.

What might a result be for the decision-maker? It could be increased efficiency, greater market share or an increased percentage of repeat customers. Other results might include greater employee utilization, reducing the cost of sales, or lowering expenses. These are all business results that are of importance to decision-makers.

The more you can tailor your communications to the specific needs of your audience, the more effective you'll be. For example, if you discuss technical specifications and ease of training with a senior level decision-maker, she probably won't particularly care. Conversely, if you talk about how your product fits into the broad business objectives of the organization, a lower level manager might find the discussion to be intellectually interesting, but it won't relate to the specific reasons for why he should buy your products. Successful communication of results depends upon tailoring what you say to meet the business interests of the person you're speaking with.

choose a style

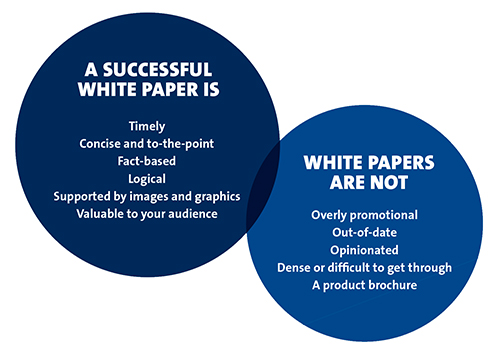

What Kind of White Paper Are You? A good white paper starts with a solid objective. Why are you creating this white paper? What is its business purpose? Leads? Sales? Thought leadership? Once you have your objective, define your audience. Which customer segments does this white paper target? Lab managers? Research scientists?

Remember that your target audience will guide the decision-making for every aspect of your white paper, from the writing style to the design layout. Craft your messaging in a way that speaks directly to your defined audience. With your audience top of mind, hone your topic. White papers are best for providing an in-depth excavation of a narrow subject matter.

For example, instead of highresolution microscopy, a more appropriate white paper topic might be exploring new techniques for in vivo imaging with fluorescent probes.

Here are four of the most common types of white papers seen in the science world.

The How-To: Always there to lend a helping hand, the HowTo provides answers to the most pressing questions of your customer base, often in a step-by-step format. As with other forms of white papers, the How-To relies on facts and industryaccepted best practices to provide guidance, and avoids any language that might be perceived as overly promotional.

The Comparer: When you find yourself at a crossroads, the Comparer lays out the pros and cons of each path. If you’re comparing your own products or services to one another, don’t be afraid to include situations in which a given product might not be best suited. With the rapid pace of innovation in lab and clinical tools, the Comparer is especially useful to scientific audiences.

The Industry Expert: The ultimate thought leadership tool, the Industry Expert provides a unique perspective on a relevant trend or industry concern. It thrives on delivering timely information or breaking down a complicated industry problem. These types of white papers demonstrate how both your technology and your insight stay at the cutting edge of the industry.

The Solutionist: The most general of the white paper family, the Solutionist presents a problem and offers a solution. Sometimes, other types of white papers will also fall into this more general category. The Solutionist is careful to be non-biased, while framing information through a lens that best benefits a company’s products or services

Outline questions

✔ The goal of your white paper. Write the white paper’s goal in bold letters at the top of your outline. This will guide each decision from here.

✔ Your audience. Include a thorough description of your target audience, including an audience profile.

✔ The white paper topic. Summarize your topic in one sentence. If you can’t do it in one sentence, your topic might be too broad.

✔ The white paper title. Give yourself multiple options. Avoid vague, cryptic headlines. Your readers should know exactly what they’re about to read.

✔ A list of main sections, with a summary of what readers will find in each one. Break your white paper into bite-sized chunks. This will not only help with your organization but benefit your readers as well.

✔ Sub-sections, for each main section. List subsections and key points each main section will cover. Also, include ideas for graphics and tables.

✔ A list of sources. Keeping your sources well organized will help speed the writing process. It could also be helpful to create a list of stats you might cite in your whitepaper.

Outline

Create and Review Your Outline The most commonly skipped step of the white paper creation process, yet also the most critical, is the outline. Organize your thoughts and assign a logical hierarchy to your white paper. When you forgo the outline and jump right into writing, the white paper you finish might not be the one you set out to write. An outline keeps you on path, ensuring each point is properly placed. Start your outline with the most basic facts and ideas, and expand out from there. Once it’s all laid out, look at your white paper from a bird’s-eye perspective. Does it flow logically? Does it answer the questions your audience will have on the topic? It’s always easier to make revisions during the outline process than after you’ve invested time into writing.

Cost of iPnone Display

IHS believes the most expensive component of Apple's latest iPhones is the display, estimated to cost $45 on the 4.7-inch iPhone 6 and $52.50 for the 5.5-inch iPhone 6 Plus and its greater pixel density. Screen suppliers are said to be LG Display and Japan Display.

Both screens are a step up from the 4-inch display on last year's iPhone 5s, which was estimated to cost about $41.

if we are strategic then pay us?

Strategic planning is an organization's process of defining its strategy, or direction, and making decisions on allocating its resources to pursue this strategy. It may also extend to control mechanisms for guiding the implementation of the strategy. Strategic planning became prominent in corporations during the 1960s and remains an important aspect of strategic management. It is executed by strategic planners or strategists, who involve many parties and research sources in their analysis of the organization and its relationship to the environment in which it competes.[1]

Strategy has many definitions, but generally involves setting goals, determining actions to achieve the goals, and mobilizing resources to execute the actions. A strategy describes how the ends (goals) will be achieved by the means(resources). The senior leadership of an organization is generally tasked with determining strategy. Strategy can be planned (intended) or can be observed as a pattern of activity (emergent) as the organization adapts to its environment or competes.

Strategy includes processes of formulation and implementation; strategic planning helps coordinate both. However, strategic planning is analytical in nature (i.e., it involves "finding the dots"); strategy formation itself involves synthesis (i.e., "connecting the dots") via strategic thinking. As such, strategic planning occurs around the strategy formation activity.[1]

elevator pitch?

We want to help JDI to sell Advanced AMOLED to Apple in any quantity required for the IPhone, iPod and iPad.

The White Paper and the Sales Cycle

Unlike the purchase of an ice cream cone, the purchase of a complex product usually requires a protracted sales cycle. The sales cycle begins with the initial review and proceeds through a more detailed evaluation, pricing and financing negotiations, service and support discussions, trials, customization discussions, and finally, a sale.

In the accompanying table, we have identified a few of the typical white papers and where they fit in the sales cycle. Most of the white paper action, as you would expect, focuses on the earlier stages.

Benefits of White Papers

The number one benefit of the white paper is that it lets you directly address an issue that is preventing prospects from moving to the next stage in the sales cycle. In addition, it lets you:

1 Cover a complex topic in depth — Unlike an ad, brochure, or product/data sheet, you can go into a single topic at considerable depth. Complex products suffer when they must be reduced and overly simplified in ways that prevent people from fully understanding the product. A white paper gives you the space that your complex product requires.

2 Gain credibility from third parties — Triangle white papers include comments from recognized experts at leading consulting firms. Their input in the white paper gives it a credibility that helps convert prospects into buyers.

3 Set the agenda, define the playing field — Too often, companies find themselves trying to explain their products in terms that have been set by others, which puts their products at an immediate disadvantage. In a white paper, you set up the presentation and discussion to showcase your product to its best advantage.

4 Advance the sales cycle — As noted above, sometimes the prospect can’t move forward until certain issues are resolved. The white paper lets you address those issues directly, in depth, and on your terms.

5 Engage the prospect — White papers can be interactive, directly engaging the prospect on the particular issue. For example, an ROI analysis can provide an online version for the prospect to provide its own numbers and calculations, a configuration guide can provide realistic models that the customer can use.

6 Speak appropriately to the target audience — To technical people you want to talk technology, to business managers you want to talk business benefits. In the white paper, you can set the level of discussion to the level of your audience.

7 Clarify your strategy and positioning — The process of developing a white paper is an effective mechanism to help the organization clearly articulate its strategy and position in regard to key issues. Triangle will help you synthesize different internal viewpoints to produce a coherent view that is meaningful to the organization and its target audience.

In all cases, the white paper ensures that a consistent, appropriate, and accurate message gets out. Whether the message is being delivered by a direct sales force scrambling to keep up with frequent new releases, channel partners who are distracted by other products they must also carry, or strategic allies you can’t control, the white paper provides your complete story. It is the play book that everybody on your team can follow.

Close the Understanding Gap

To close the understanding gap, marketers of complex products use whitepapers, case studies, online return on investment (ROI) calculators and other marketing tools.

A white paper is a printed or online document that describes a product or technology, how it is used, the benefits that accrue to the buyers and the overall impact of the technology or product on an organization.

The specific content and structure of a white paper varies, based on the type of product or service being described, the intended audience and other factors. Some white papers focus on an analysis of the ROI potential of the product. Or they explain the product's technology at considerable depth for the technical people doing a detailed evaluation.

The white paper contents follows the old maxim — form follows function. The format of the white paper should be tailored to meet the intended goals and audience of the white paper. And the key goal of a white paper is to provide prospective buyers with the explanation necessary to enable them to move to the next step in the purchase cycle.

The white paper is just one of many weapons from the communications arsenal for marketers of complex products. It works in conjunction with case studies, advertising, brochures online ROI calculators and product/data sheets, which provide less detailed information. Together these tools provide a comprehensive approach to the marketing and selling of a product. The advertising and other collateral first generates initial interest, while and the white paper follows up with more detail. In all cases, the white paper closes the understanding gap by addressing the need of a particular audience for more information about your product.

White papers are especially effective when aimed at specific problems. If prospects aren’t buying your product because they don’t understand the payoff, you can develop a benefits and ROI white paper. If they are worried about how it will work in their environment, you can develop an integration white paper. If the sheer number of configuration possibilities seems confusing, then develop a configuration white paper. Where there is intense competition, a competitive positioning white paper differentiates you from the pack. When people don’t even realize that they have a need, the white paper can fill in the picture for them. Whatever the obstacle, a white paper can be developed to address it.

Vendors should be cautioned against wanting a white paper to just talk about the wonders of their product, in excruciating detail. A much more successful strategy is to frame the discussion in terms of larger issues of importance to the audience. Otherwise, the white paper will be regarded as little more than an extended ad.

Why?

If JOLED truly understands that we are going to disrupt LTPS with better performance and better production then JOLED should invite us to discuss owning 20% of our startup.

Overview Document First!

Understand that the most effective white papers are those that have the voice and authority of recognized third parties. Creating a white paper internally is usually a time consuming, frustrating and ultimately less satisfying approach. You and your colleagues are paid by the shareholders to create, sell and maintain hardware or software, not to write, design and print a white paper.

Also, a properly briefed outsider brings critical perspective to the content, which is the true source of the paper's credibility. We approach the issue as if we were the prospects, speaking to them and their interests in a voice that is not the company's but more like the prospect's own.

The first step in crafting a white paper is understanding the goals and then articulating the white paper's mission. Triangle's methodology for this process is called the issue plan. After extensive discussions with the sponsor, and research to determine what has already been prepared for this market, Triangle will submit a document that contains the following elements:

1 Description of the goals

2 Description of the target audience

3 Summary of the white paper topics

4 Questions to be answered

5 Art elements to be developed (charts, text tables, illustrations, etc.)

6 Sources — which experts, customers and sponsor officials will be contacted

7 Timetable

8 Copy flow — who is responsible for what

Following the Triangle methodology will assure delivery of the best product with the least aggravation, and at the lowest possible cost.

on LTPS TFT LCDs - from 2014

LTPS TFT LCDs Growing to Half of All Mobile Phone Display Revenue in 2020, According to NPD DisplaySearch

Demand for high resolution and low power consumption driving growth and supporting higher prices SANTA CLARA, CALIF., January 20, 2014—Ongoing advances in smartphone functionality are driving increases in screen size and pixel density, even as power consumption continues to be a critical performance issue.For these reasons, low temperature polysilicon (LTPS) TFT LCDs are increasing their share of the mobile phone display market. LTPS-based displays enable high resolution at lower power consumption than other panels, and they can therefore command higher prices. According to the latest NPD DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report, LTPS TFT LCDs had a 37% share of mobile phone display revenues in 2013, surpassing AMOLED displays, a-Si (amorphous silicon) TFT LCD, and oxide TFT LCD. The mobile phone revenue share of LTPS-based displays is expected to reach 44% in 2014 and 51% in 2020, as shipment share increases from 19% in 2013 to 33% in 2020. “Despite the added complexity in producing LTPS TFT LCDs, requirements for higher resolution and longer battery life in smartphones will continue to drive growth in this technology,” said David Hsieh, Vice President of the Greater China Market at NPD DisplaySearch. “Meanwhile, after a decade of manufacturing experience, many LTPS TFT LCD panel makers have reached high yield rates, which enable high production volumes.” Table 1: Mobile Phone Display Revenues Shares by Display Technology Technology 2013 2014 2020

AMOLED 35% 36% 30%

a-Si TFT LCD 27% 19% 18%

LTPS TFT LCD 37% 44% 51%

Oxide TFT LCD

<1%

<1% 1%

Source: NPD DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report A higher process temperature is required to manufacture LTPS, compared to traditional a-Si or oxide TFT manufacturing, and the photomask process is more complicated. While the standard a-Si TFT process requires five to six photomask steps, LTPS TFT requires nine to 12, which increases capital investment required and increases the difficulty of achieving high yield rates. For 5" smartphone panels with 1920 ×1080 resolution, a LTPS TFT LCD panel costs 14% more than a-Si TFT LCD, due mainly to lower yield rate and higher equipment cost. The key difference of LTPS TFT is higher electron mobility, which enables smaller TFTs and thus higher pixel density and integration. “The benefits of LTPS are higher pixel density, lower power consumption, and integrating driving circuits on the glass substrate,” Hsieh said. For mobile phone displays with pixel density higher than 300 ppi, LTPS TFT LCD is the preferred technology, which is why many panel makers are now gearing up development of LTPS, including Taiwanese manufacturer AUO, Chinese manufacturers BOE, Tianma, InfoVision, and Century. At present, LTPS TFT LCD production is dominated by three players: Japan Display, Sharp, and LG Display. While smartphones have been the dominant application for LTPS TFT LCDs, LTPS is also being adopted for high resolution tablet PCs. At the recent Consumer Electronics Show (CES), Samsung announced the first LTPS-based tablet PC, the Galaxy Tab pro. The Quarterly Worldwide FPD Shipment and Forecast Report reports quarterly worldwide shipments for all major flat-panel-display (FPD) applications. With more than 140 FPD producers across more than 10 countries, the Quarterly Worldwide FPD Shipment and Forecast Report analyzes historical shipments and forecast projections to provide detailed information and market insights. For more information about this report, or NPD DisplaySearch information offerings generally, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional NPD DisplaySearch office in China, Japan, Korea or Taiwan.

How to Produce A Successful White Paper,

Selling complex products — a piece of industrial equipment, computer hardware or software, telecommunications equipment, medical devices, advanced technology of any sort, or the services that go along with such a product — takes more than a "shoeshine and a smile," to use Willy Loman's favorite expression.

The individuals who make — or at least approve — the final purchase decisions and who sign the checks often are not the primary users of the complex product. The authorizers typically do not understand the product's advantages or how those advantages translate into benefits for their organization. Ironically, the individuals who benefit the most may actually have little say in the decision.

In fact, the individuals assigned to evaluate, implement and use the product day in and day out usually don’t fully understand the product either. Frequently they are ill-prepared to explain benefits to the people who approve the purchase and sign the checks.

And the lack of understanding about complex products doesn't stop there. Your own sales force, channel partners, and strategic allies may not fully understand your product. And if they don't understand it, they can't effectively communicate your key messages in a consistent way.

How to bridge these gaps? People buy complex products when they understand what the products will do for them, how the products fit into whatever else they are doing, where the value lies, and how to evaluate and configure the right purchase. When they don’t understand something, the sales process sputters and stalls.

Distribute The White Paper

Once the white paper has been completed, there must be a distribution strategy.

White papers become shelf ware when you don’t have a plan for integrating them into your overall business strategy, marketing campaign, and sales cycle. The objective is to get the white paper into the hands of the audience where it can do its job.

Here are some approaches organizations take to incorporate white papers into their business strategies:

1 Reward for responding to Advertising — Thought Leader, ROI Analysis, and Competitive Analysis white papers make effective advertising fulfillment pieces in a strategy to attract qualified prospects.

2 Direct sales force — An effective way to educate the sales force and give them the ammunition to respond when a prospect poses one of those difficult questions that demand a complete and coherent response.

3 Other sales channels — A means to ensure that sales partners have a complete, authoritative, and consistent message at their fingertips, allowing them to effectively handle challenging questions.

4 Strategic partners — A means to ensure that strategic partners have a complete, authoritative, and consistent message at their fingertips, allowing them to effectively handle challenging questions.

5 Service and support — Increasingly, service and support personnel get involved in the early stages of the sale, instead of after the sale is concluded. They too need to understand the key issues and be equipped to respond to the concerns of prospects.

6 Employees — In customer-focused organizations, every employee is a potential sales person. They need to understand your products and be able to get the right answers for customers and prospects.

7 Corporate channels — Stakeholders of all sorts (regulators, the community, the press, industry analysts, stockholders and investors) need to understand your complex product and the issues surrounding it so they can better play their parts. White papers are a crucial part of your web site.

8 Other web sites — Distributing the white paper via Bitpipe will deliver the messages to 21.7 million web site visitors of the leading trade and business publications.

We find that white papers have substantial pass-along value. A technical person, for example, may not have much interest in the business benefits of the product, but having a business benefits white paper at hand helps that person make a business case for the product to those who do care about the business benefits.

For more information about how to develop a successful white paper, contact Larry Marion of Triangle Publishing Services Co. Inc. 617-244-0698, or lmarion@triangle-publishing.com © 2002 Alan Radding

reduce Fab costs for AMOLED

How to reduce large-size AMOLED display fab costs August 9, 2012 — Active-matrix organic light-emitting diode (AMOLED) displays are growing rapidly and offer many performance benefits over liquid crystal displays (LCDs). However, 55” AMOLED TV displays cost 8-10x as much as a comparable LCD to manufacture.

Also read: AMOLED manufacturing improvements to enable TV market share grab

According to the NPD DisplaySearch AMOLED Process Roadmap Report, the manufacturing cost of a 55” oxide TFT-based AMOLED using white OLED (WOLED) with color filters is 8x that of a high-end TFT LCD display of equal size. The cost multiplier of a 55” AMOLED module using red, green, and blue (RGB) OLED is 10x. These higher costs are mainly a result of low yields and high materials costs.

LCD manufacturing is a mature process with slower, more incremental cost reduction. AMOLED cost reduction efforts are in their infancy, said Jae-Hak Choi, senior analyst, FPD Manufacturing for NPD DisplaySearch. These could include new and improved processes, printing technology, and higher-performance materials that will take AMOLED prices to parity with LCD in the long term.

Relative manufacturing costs of technologies for 55” TV panels. Based on current yield and material cost assumptions. Source: NPD DisplaySearch AMOLED Process Roadmap Report.

Figure. Relative manufacturing costs of technologies for 55” TV panels. Based on current yield and material cost assumptions. Source: NPD DisplaySearch AMOLED Process Roadmap Report.

In order to scale up to large sizes, advancements in several aspects of AMOLED manufacturing are needed, including the active matrix backplane, organic material deposition, and encapsulation. Because oxide thin-film transistors (OTFT) require lower capital costs and are similar to existing amorphous silicon TFT (a-Si TFT), the technology offers a strong alternative to the low-temperature polysilicon (LTPS) TFT currently used for AMOLED. However, there are many hurdles for mass production of oxide TFT, particularly threshold voltage shifts, which are continuing to prove problematic for AMOLED production.

Relative manufacturing costs of technologies for 55” TV panels. Based on current yield and material cost assumptions. Source: NPD DisplaySearch AMOLED Process Roadmap Report.

Figure. Relative manufacturing costs of technologies for 55” TV panels. Based on current yield and material cost assumptions. Source: NPD DisplaySearch AMOLED Process Roadmap Report.

In order to scale up to large sizes, advancements in several aspects of AMOLED manufacturing are needed, including the active matrix backplane, organic material deposition, and encapsulation. Because oxide thin-film transistors (OTFT) require lower capital costs and are similar to existing amorphous silicon TFT (a-Si TFT), the technology offers a strong alternative to the low-temperature polysilicon (LTPS) TFT currently used for AMOLED. However, there are many hurdles for mass production of oxide TFT, particularly threshold voltage shifts, which are continuing to prove problematic for AMOLED production.

While indium gallium zinc oxide (IGZO) and other forms of oxide TFT show great promise for backplanes, progress in scaling up LTPS production is also being made by increasing the excimer laser beam width to 1300 mm. In addition, the current method of depositing red, green, and blue materials by evaporation through a fine metal mask is being continuously improved. Pixel densities of 250 ppi are now possible, and over 280 ppi is feasible.

“High resolution patterning such as laser induced thermal imaging (LITI) and material improvements are still required for AMOLED to be highly competitive for super-high-resolution flat panel displays,” Choi said.

Manufacturing processes for small, 4” AMOLED displays are more mature, creating a much smaller cost premium over LCDs (<1.3x). Most AMOLED capacity is currently dedicated to small/medium production for smart phones, but much of the future capacity increase will be driven by fabs dedicated to TV production. Uncertainties abound, as AMOLED technology has not yet been proven in large-size TVs.

Based on planned investments, NPD DisplaySearch forecasts that the AMOLED market will grow nearly tenfold from 2.3M square meters in 2012 to more than 22M in 2016.

Samsung Display has been highly successful in its small/medium AMOLED production because it has been able to raise yields to near-LCD levels. This implies that manufacturers can potentially lower large-size AMOLED TV costs to be competitive with LCD TVs in the future.

a-Si vs LTPS

The Coming War in the FHD Market Between a-Si and LTPS October 02, 2014 By Terry Yu Recently, Apple announced that its latest iPhone 6 and 6 Plus hit a record 10 million sales in the first weekend of release. Although we do not know the share of iPhone 6 Plus in that 10 million, it is clearly a positive sign for the FHD smartphone market. The direct impact of iPhone 6 Plus is that Android-based flagship models will have to strengthen their current FHD resolution displays and move to WQHD resolution displays. Even the iPhone 6 with a 1334 × 750 Retina display could be positive for Android-based FHD smartphone modules. How does this affect the choice between a-Si and LTPS technologies for FHD? More Viable a-Si Based FHD Solutions The real demand for future LTPS capacity is still being discussed. The viewpoint of the opposition is that a-Si could support FHD products soon and drive LTPS capacity to the WQHD resolution market. From the current view, a-Si TFT is actually expanding its production portfolio from 720 HD to FHD resolution, and here are some panel makers’ latest developments: BOE: BOE is one of the most aggressive panel makers for a-Si based FHD smartphone displays. BOE began to actively promote them to local Chinese clients at the beginning of 2014. However, no brands intend to try a-Si based FHD products, so BOE has postponed its shipment plans several times. Its first shipment will be of 5.5’’ FHD products with both real RGB and rendering solutions. Tianma: Tianma’s Gen 5.5 LTPS capacity is effective already, so its priority is finding LTPS FHD solutions. However, Tianma is still studying a-Si FHD as a backup. Its first a-Si FHD sample will also be a 5.5’’ FHD product, but using RGBW rendering. IVO: After focusing Gen 5 capacity on small/medium applications, IVO is now the major smartphone OEM cell supplier in the south China market. To improve revenue and profit, IVO wants to improve its product portfolio, including a-Si based FHD product plans. IVO’s first a-Si FHD sample is 5.5’’ with real RGB. IVO noted that its real RGB solution relies heavily on the adoption of negative LC. AUO: Like Tianma, AUO also has mature LTPS capacity with pretty good technology advantages. For example, AUO is the supplier of Vivo XPlay3S, the first WQHD smartphone all over the world. So far, LTPS based FHD smartphone displays are still the major choice for AUO, yet, its internal customer still has a back-up plan. During Touch Taiwan in August, AUO demonstrated an a-Si based 5’’ FHD sample, with a remarkable 1.0 mm cell border. Innolux: Compared with other panel makers, Innolux has a cautious attitude toward LTPS investment. Accordingly, Innolux will rely more on a-Si capacity for the growing FHD smartphone display market. During Touch Taiwan, Innolux also demonstrated an a-Si based 5’’ FHD sample, but with a 1.2 mm border design. Figure 1 IVO 5.5’’ a-Si Based FHD Display with Negative LC Solution  Source: IVO Potential a-Si Based FHD Solutions Currently, 720 HD is still the most popular high resolution for the a-Si process, with a typical ppi range of 258-312 ppi (from 5.7’’ to 4.7’’). To produce FHD displays, panel makers will have to improve their a-Si product ppi to 386-441 ppi (from 5.7’’ to 5’’). This will be a huge challenge for a-Si, especially for old production lines. Some potential solutions could be helpful for a-Si based FHD designs: Real RGB design: Real RGB definitely has the best picture performance, but will face challenges. To improve, two solutions are currently being considered. One solution is photo-alignment technology, which was once used in VA type LCD TV panels to improve the aperture rate. Photo-alignment is also getting popular in IPS smartphone displays and was mentioned in the iPhone 6 and 6 Plus introduction. The higher aperture rate will be helpful to solve the matter of larger a-Si TFT sizes. AUO’s 5’’ FHD sample likely adopts a photo-alignment design. Another solution is negative LC with the same effect. Negative LC has better transmittance performance that could be helpful for a-Si based FHD design. However, the negative LC still faces slow deflection matter and immature applications that panel makers will have to co-work with LC suppliers closely to resolve. Rendering: Rendering is well-known as Samsung’s PenTile sub-pixel alignment, but could also be a good solution to lower the challenge of a-Si based FHD products. RGBW would be the easiest solution, similar to JDI’s White Magic design. However, when improving the brightness performance, color wash out occurs. Another solution is called Rainbow from Yunyinggu, a local Chinese company located in Shenzhen. The Rainbow solution is specially designed using RGB rendering to avoid color wash out, but the chip IC cost is another concern. Technology War and Future Scenarios The truth of the argument between a-Si based FHD and LTPS based FHD is related to panel makers’ investment plans. For current LTPS panel makers, LTPS will always be their first choice. For example, JDI has no a-Si based FHD plans, and even for AUO, the a-Si based FHD study is a back-up only. Panel makers with limited LTPS capacity will improve the a-Si process and try to expand into the FHD resolution market. For example, Innolux does not have aggressive LTPS investments yet and intends to develop a-Si FHD designs. It is still hard to see the outcome from the present situation, with no mature a-Si based FHD display shipments yet. However, here are the potential scenarios: Real RGB design: LTPS has a high possibility of winning. Both photo-alignment and negative LC solutions are already adopted in LTPS products. The lower mask is the only advantage of a-Si. However, after 2016, LTPS capacity will expand significantly so that panel makers will have to fight stronger to survive in the market. As a  result, LTPS FHD ASPs will also fall to a new level that could impact a-Si based FHD products. On the other hand, with real RGB sub-pixel designs, LTPS has the potential to dominate all WQHD+ markets and most FHD markets. Rendering: Rendering sub-pixel design is still uncertain and depends on panel makers’ marketing strategies. However, rendering could still be the potential solution for a-Si based FHD displays to survive in the mid-range smartphone market with FHD designs, due to the lower prices. Furthermore, the more important impact could be in the lower resolution market. For example, panel makers could raise smartphone resolution from WVGA to 720 HD through rendering. Especially when all Gen 8 capacity is released in the future, there could be more Gen 5 or Gen 6 a-Si capacity transferred to the mobile phone market, leading to stronger competition. Panel makers may introduce rendering designs from FHD to the 720 HD market to survive in the low-end smartphone market, but with much larger volume.

AMOLED price dropping?

AMOLED Mobile Phone Panel Costs Expected to Fall Below LCD, According to NPD DisplaySearch

Santa Clara, Calif., July 16, 2014—Improvements in production yields of AMOLED mobile phone panels are closing the manufacturing cost gap between AMOLED and TFT LCD smartphone displays. According to the NPD DisplaySearch OLED Technology Report,manufacturing costs for AMOLED panels are currently 10-20% higher than for TFT LCD displays; however, manufacturing costs for AMOLED mobile phone displays are expected fall below costs for LCD mobile phone displays within two years due to rapid improvement in AMOLED panel production yields. Early on, AMOLED panels were expected to cost less than LCD panels, because they do not require backlighting. Instead, production challenges kept AMOLED yields low, so costs remained higher than for equivalent LCDs. AMOLED became a high-end product, due to its high color gamut, good contrast, and slimness. Recent production yield improvements are expected to help AMOLED penetrate more broadly into smartphone panels. “Until recently there have been few breakthroughs in the production of AMOLED displays, and the OLED industry seemed to be facing hard times,” said Jimmy Kim, senior analyst of display materials and LED at NPD DisplaySearch. “If AMOLED costs fall below LCDs, as expected, it would lead to more opportunities for the OLED display industry, greater competition with LCD, and more choices for consumers.” For example, currently there is a 16% cost gap between 5" AMOLED and LCD 1920 × 1080 mobile phone panels, but AMOLED panel costs are expected to fall below LCD panel costs when AMOLED production yields reach 90%, which is within sight. With cost reductions for OLED materials, the yield rate can be lower and still have a similar effect.